Why the automotive industry must change

The automotive industry is facing the most significant transformational period in its history: replacing the internal combustion engine, which dominated the powertrain for more than a hundred years, with more sustainable technologies.

This colossal change is driven by the greatest challenge of the present: climate change.

The road to e-mobility – and its branching regional paths

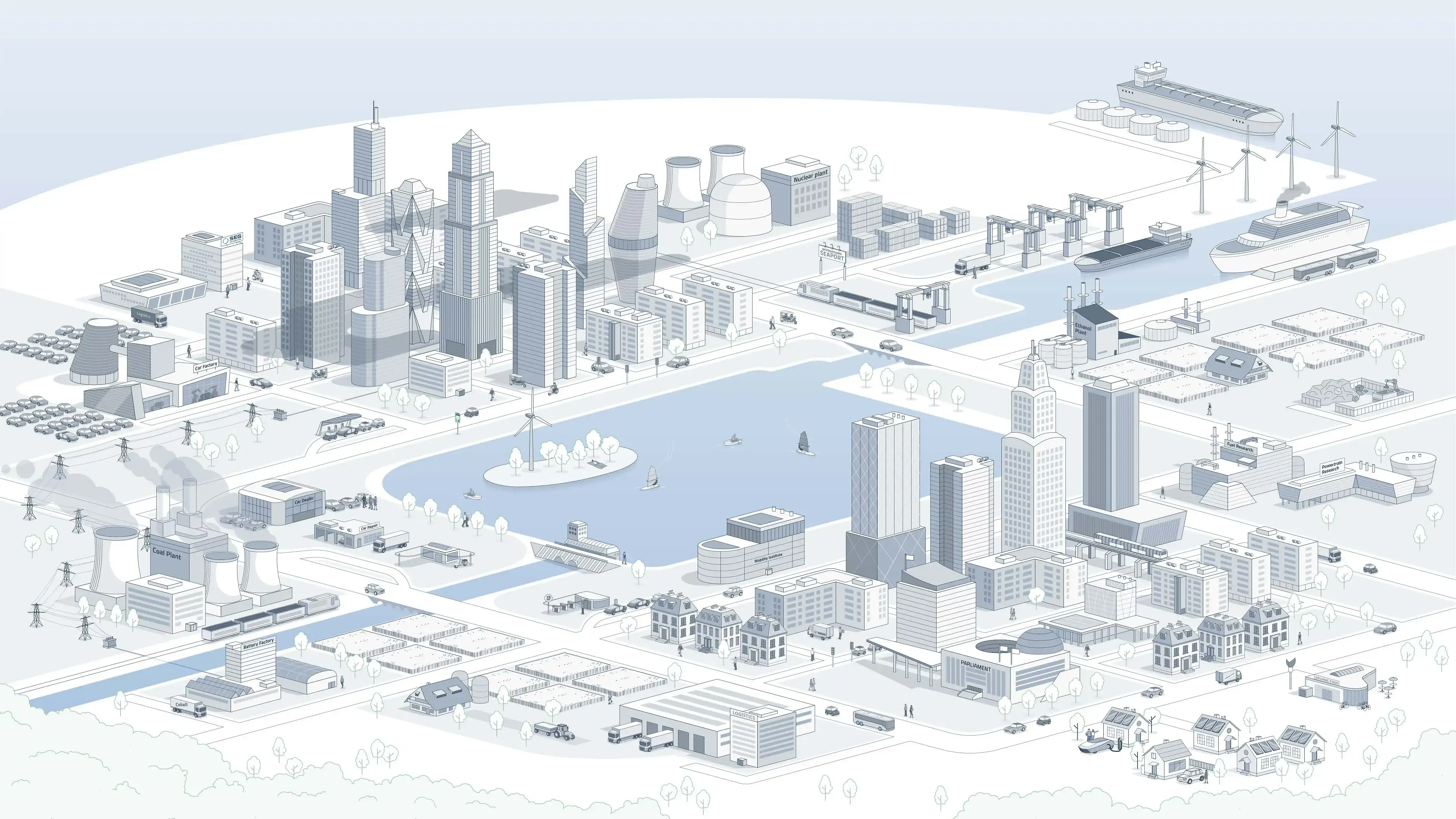

Individual mobility and the automotive industry are facing the greatest transformation in their history, driven by the three megatrends electrification, connectivity and autonomous driving. Together, they will change how cars are powered, driven and owned. Electrification, the shift from internal combustion engines to an electric powertrain, also plays an important role at the global level in curbing man-made climate change.

E-mobility is coming, there is no doubt. But how quickly and with what regional differences? Which factors – such as battery technology and consumer acceptance – influence the speed of its prevalence? And how are the different market conditions and policy shaping the solutions in the key automotive markets? And what short-term solutions are available to significantly reduce CO2 emissions even before the breakthrough of e-mobility?

These are the questions we are looking to answer on this page, including a detailed look at the status quo and the development of the world market as well as the key regions China, Europe, USA, India, and Brazil.

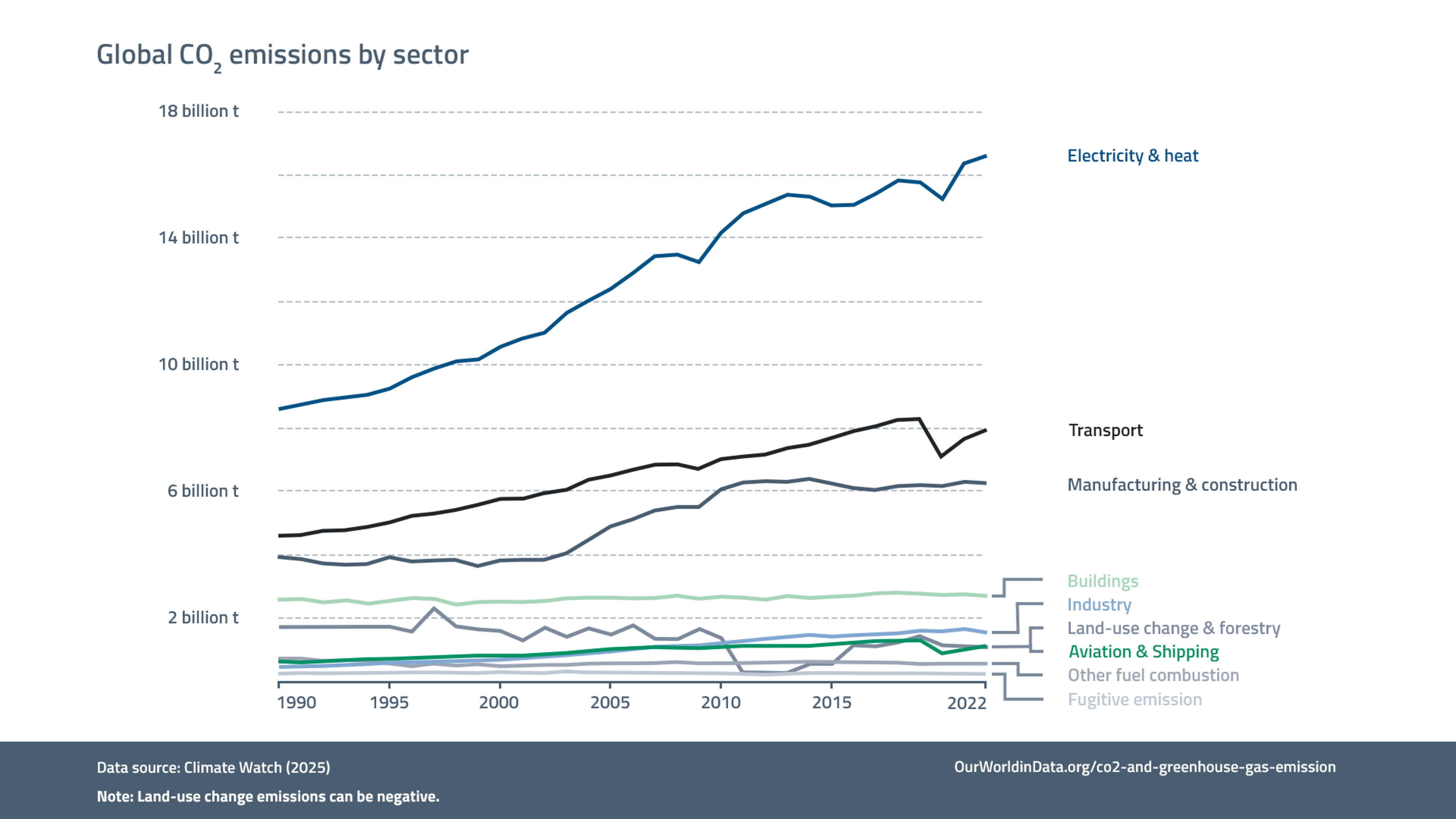

What is the role of the transport sector in climate change?

The transport sector's energy hunger has been continually on the rise, except for a small ‘dent’ through the pandemic. Transportation is responsible for more than one third of the total global energy consumption.

Cars and trucks account for a large part of this load – in Europe, for example, they are responsible for over 20% of total CO2 emissions.

The pressure on the automotive industry – on manufacturers and their suppliers – to change their product portfolio has been enormous. But in recent years, policy pressure by governments in major markets like the US and EU has been decreasing in the name of ‘pragmatism’ (see driver and hurdles for the transformation).

Still, there is no doubt that to counteract climate change, CO2 emissions from the transport sector must be significantly reduced – until eventually passenger cars and commercial vehicles produce no emissions at all.

Why are vehicles with electric drives of such importance?

Battery-powered electric vehicles are imperative for truly zero-emission mobility. E-mobility is not only the politically preferred solution for passenger cars; it actually offers clear technological benefits.

Above all, it has a much higher energy efficiency in the well-to-wheel consideration than other available technologies.

As soon as renewable energy is available in unlimited quantities, electric cars will be the easiest and most energy-efficient way to drive locally and globally with zero emissions.

How is the global e-mobility market developing?

Sales of electric cars continue to rise – with an expected global production in 2025 upwards of 16 mio. units. This global market share of ~17% is a strong development – up from only 2% in 2018 – though not quite as fast as expected due to evolving political and industrial dynamics.

Initially driven by strong subsidies and incentives, recent shifts toward more "technology-neutral" policies have diluted the focus on battery electric vehicles (BEVs). In regions like Europe, political support is now extending to hydrogen and e-fuels, while some governments reduce or phase-out blanket EV incentives, slowing market growth.

Tight profit margins, volatile battery metal prices and high inflation further compound the need for Automakers to diversify their strategies. While BEVs remain a priority, many OEMs are abandoning their previous “EV-only” platforms in favor of architectures that can support different propulsion technologies, including ICE, hybrid and potentially even hydrogen. This way, they hedge against uncertainties in the political landscape and consumer behaviour, as well as potential supply chain issues, e.g. for critical battery materials. Rising energy prices and uneven charging infrastructure further temper consumer demand, particularly in emerging markets, where government support is weaker.

Though the long-term trajectory of e-mobility remains positive, the transition is increasingly marked by automakers adopting technology-flexible platforms rather than a singular shift to electric vehicles. Still, based on current forecasts, EVs are expected to more than double their market share to around 36% by 2030.

What are the drivers for electrification?

The ongoing shift towards e-mobility is being propelled by a combination of environmental concerns, regulatory pressures, and evolving consumer preferences. The key drivers for electrification are as follows:

- Rising Social Awareness & Consumer Demand for Green Solutions: Public consciousness regarding climate change and air quality continues to grow. As environmental awareness rises, consumer preferences are shifting towards cleaner, more sustainable transportation options, boosting EV adoption.

- Decarbonization Policy and Incentives: Governments worldwide are putting in effort to reduce CO2 emissions to meet climate targets, pushing stricter regulations and zero-emission mandates, especially in the transportation sector. Despite some reductions in subsidies, in many markets there are still significant tax incentives, grants, and/or rebates for EV purchases and infrastructure development, encouraging market growth.

- Improved Battery Technology: Advances in battery efficiency, energy density, and cost reductions have significantly lowered the price of electric vehicles, making them more accessible and practical for consumers.

- Energy Security Concerns: The volatility of fossil fuel markets, driven by geopolitical tensions, is motivating countries and consumers to pivot towards electric mobility to reduce dependence on oil and gas.

What are the hurdles slowing down widespread electrification?

Despite the momentum behind e-mobility, the transition faces several significant obstacles that continue to hinder widespread adoption and market growth:

- Consumer Hesitation and Knowledge Gaps

Many consumers remain skeptical of EV performance, longevity, charging infrastructure limitations. High upfront costs and uncertain resale values are further deterrents, while unfamiliarity with EV technology and maintenance continues to slow widespread adoption, particularly among older demographics.

- Insufficient Charging Infrastructure

While expanding, charging networks remain unevenly distributed, particularly in rural or developing regions, leading to concerns over range anxiety and accessibility.

- Raw Material Supply Issues

The availability of key battery materials, like lithium or cobalt, remains a critical challenge, with supply bottlenecks and ethical concerns driving up costs and slowing expansion. - Energy Grid Challenges

Increased EV adoption places additional demands on power grids, necessitating upgrades and a shift toward renewable energy sources to avoid shifting emissions from vehicles to power plants. - Policy Uncertainty

Shifting political priorities and varying regional approaches to subsidies and regulations can create market instability, making it difficult for automakers to plan long-term investments confidently.

Why do many consumers still hesitate to buy an EV?

Despite the growing emphasis on climate protection and stringent government regulations aimed at promoting electric vehicles (EVs), several key factors continue to deter consumers from making the switch.

Cost considerations remain a huge barrier, especially the High Upfront Price as EVs still typically cost more than comparable traditional internal combustion engine (ICE) vehicles, especially now that many governments are cutting back on subsidies. Total Cost of Ownership concerns include not only the higher initial price but also potential expenses related to battery longevity and repairs.

Resale Value also remains unpredictable due to rapid technological advancements and potential battery degradation, making investing in EVs an uncertain investment to many.

Practical considerations also still impact consumer confidence. Range Limitations coupled with the perceived inconvenience of frequent charging contrasts with the simplicity of refueling traditional vehicles. This is compounded by an uneven Charging Infrastructure across the globe. Depending on their home country and whether they live in rural areas, people still have Range Anxiety.

Lastly, the individual consumer rarely acts completely rationally, especially when buying a car. Environmental Awareness may be overshadowed by Personal Preferences and immediate practical needs. Brand Loyalty remains significant, as consumers often favor established brands known for reliability over newer EV manufacturers. Particularly in the premium segment, many buyers prioritize brand prestige and view their vehicle as a status symbol. Additionally, the exact CO2 Footprint of a vehicle is often not transparent to the consumer, leading decisions to be driven more by personal and cost/benefit considerations rather than purely environmental factors.

What are the necessary steps towards electromobility?

The political focus on e-mobility promotes the long-term transformation towards Net Zero Emissions. This is important and necessary, but not sufficient on its own.

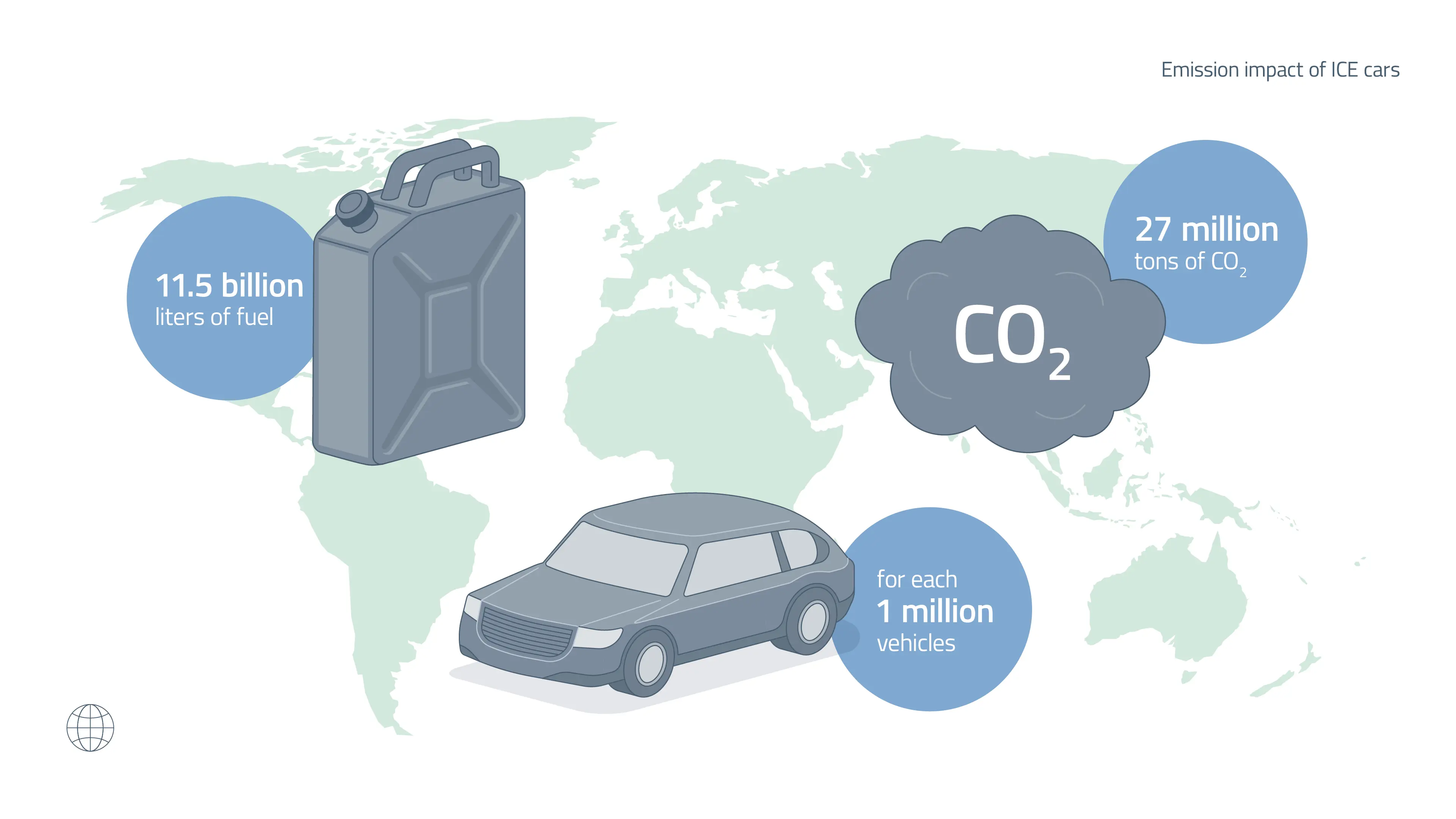

If, for example, 100% of electricity in Europe comes from renewable energies by 2050 and you can only buy electric cars, they will actually produce no more CO2 emissions in everyday life. However, this only applies to new vehicles – and only in Europe. The cars that we register worldwide in the coming years will be the stock of the near future for a considerable period of time – and these will include up a hundreds of millions of new combustion engine vehicles.

The transition to EVs cannot be accelerated at will – after all, technology, battery availability, infrastructure, and renewable energy generation must be further developed simultaneously. This is already a challenge in Europe – even more so in less developed markets..

Every combustion engine produced currently and in the future must therefore have the lowest possible CO2 footprint on the road, especially from a global perspective and with the growing mobility in emerging countries in mind.

What conditions need to be met for a successful transformation of mobility?

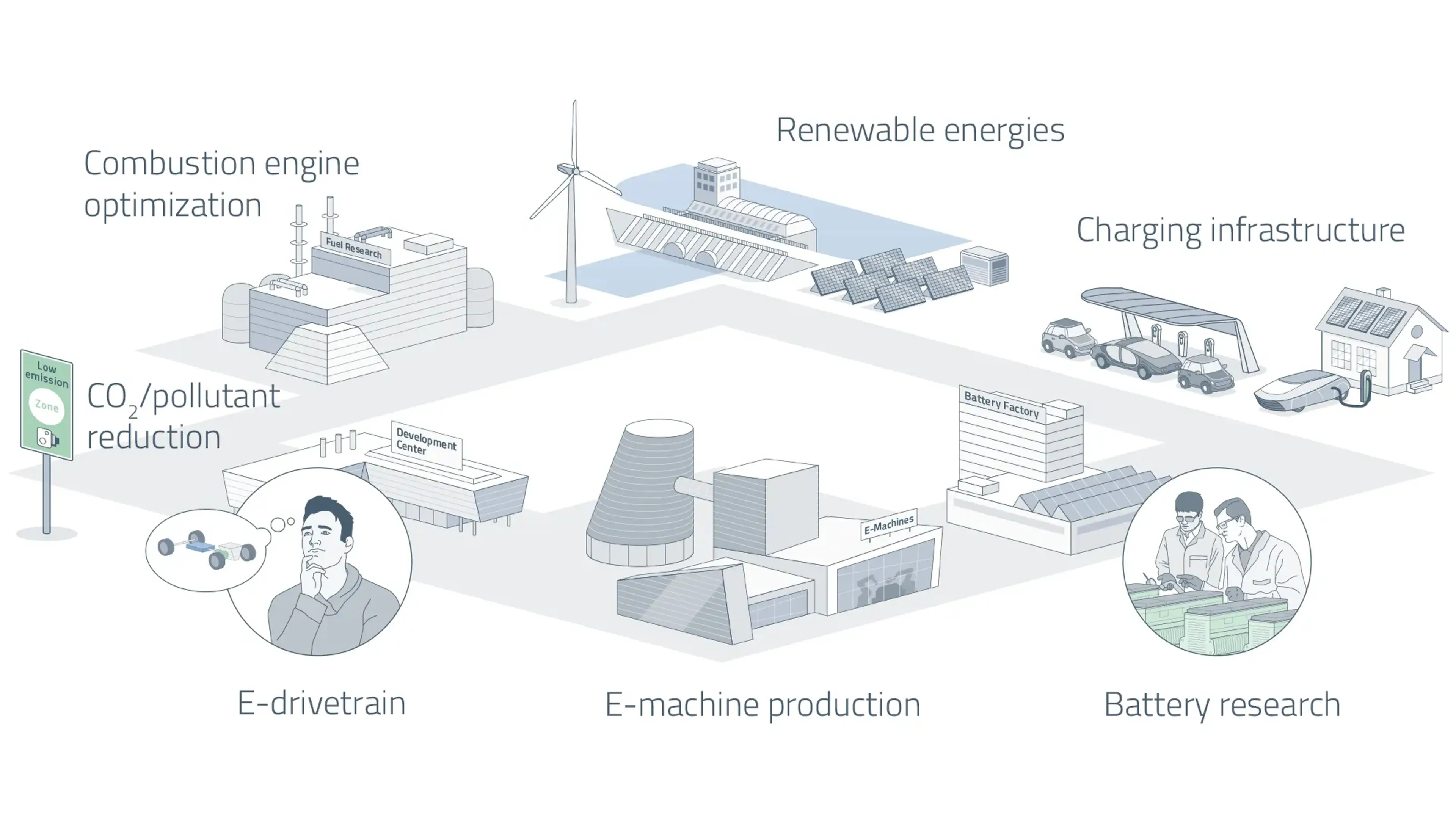

Due to their currently significantly better well-to-wheel energy efficiency, battery-powered electric vehicles are the best solution for passenger cars in the medium and long term. Nevertheless, further large-scale investments are needed here as well.

At the same time, it is foreseeable that not all mobility needs can be met by battery technology in the medium and long term – battery-electric aircrafts or freight ships, for example, are stretching the limits in terms of weight and range. And even in private transport, it will take decades for the switch to e-mobility to become truly widespread. Where batteries are currently inconceivable as an energy source, other solutions can and must contribute in a significant way.

This is why investments are needed not only in BEVs, but also in alternative technologies, infrastructure, and renewable energies for the entire mobility and production sectors. This is the only way to make the necessary contribution to climate protection.

So the most sensible approach is a clear commitment to electrification – but without losing sight of other technologies such as 48V hybridization. In this way, we achieve the highest savings in the short term and find the best solutions in the long term – for aircrafts, for example, this could be green hydrogen or synthetic kerosene.

Why does e-mobility grow and develop differently in various world regions?

The expansion and development of e-mobility are influenced by a complex interplay of regional factors, resulting in diverse trajectories across the globe. Key determinants of this variation include CO2 regulations, upfront costs and total cost of ownership, energy mix, and charging infrastructure, which collectively shape the feasibility and attractiveness of electric vehicles (EVs) in different markets.

- CO₂ Regulations: Emissions standards and CO₂ targets remain a major lever for encouraging the shift to EVs by increasing compliance costs for traditional combustion engine vehicles. Recently, the picture has become even more fragmented and complicated. While some regions like Canada continue to pursue aggressive zero-emission mandates, In regions with less consistent or weaker regulatory frameworks, the transition remains slow and uneven. Notably, the United States and even the European Union have cast doubt on their regulatory measures, creating greater uncertainty for OEMs.

- Upfront costs and total cost of ownership: Raw material costs, e.g. for battery components, alongside policy decisions, particularly regarding subsidies, import duties and tariffs, significantly influence the relative cost of EVs compared to internal combustion engine (ICE) vehicles. In China, in many cases EVs are already the cheaper choice, while in Europe and the United States electric cars remain 10% to 50% more expensive than combustion engine equivalents, depending on the country and car segment – and on the further development of the global tariff situation.

- Energy Mix: The source of electricity used to charge EVs plays a crucial role in determining their environmental impact. Countries with a high share of renewable energy in their electricity mix, such as Norway and certain European nations, can offer more sustainable EV options compared to those heavily reliant on fossil fuels. This disparity affects the perceived benefits of EVs and their adoption rates.

- Charging Infrastructure: The availability and development of charging infrastructure are critical for supporting the growth of e-mobility. Regions with extensive and accessible charging networks, such as China and parts of Europe, are better positioned to facilitate widespread EV adoption. Conversely, areas with limited charging infrastructure face significant barriers to market penetration and consumer acceptance.

This combination of local conditions and global trends shapes the pace and nature of electrification across the globe. For example, while China leads in electric car sales and affordability, Europe and the United States follow with varied progress influenced by their regulatory environments and market structures. Conversely, India, although slower to adopt EVs in the traditional automotive segment, is making significant strides in Light Electric Mobility (LEM).

How is e-mobility developing in Europe?

The European e-mobility landscape continues to be shaped by a mix of stringent policies, political pressure, and regional diversity, creating a unique trajectory for vehicle electrification. At the heart of this transformation have been the EU's aggressive CO2 emission targets, which mandate a reduction to 49.5g/km by 2030, enforced by heavy fines for non-compliance, along with a total ban of new ICE vehicles from 2035. While this plan remains officially in place, recent policy shifts and growing political pressure could re-shape its eventual implementation.

Major political forces – such as the European People’s Party – have called for revisions or delays to the 2035 ban, citing economic concerns and consumer affordability. Germany and Italy have also advocated for exemptions for vehicles running on synthetic fuels and plug-in hybrids, underlining the increasingly contested nature of Europe’s regulatory path. In response to industry concerns and slower-than-expected EV adoption in some markets, the European Commission has eased short-term requirements, allowing automakers to average emissions over multiple years (2025–2027) rather than meeting strict annual targets.

Despite this, the pressure on manufacturers to decarbonize remains high. In 2018, ICE powertrains still dominated with a 95% market share on new vehicles. In 2025, EVs will reach around 15% market share, with 48V and plug-in hybrids adding up to another 38%. By 2030, Europe is expected to become a predominantly electric market, with EVs making up 53% of new car sales.

The market's dependency on political decisions – especially regarding financial incentives – remains a critical factor. The recent removal of purchase subsidies in Germany, for example, led to a marked drop in EV sales, with market share falling from 25% in 2023 to 20% in 2024.

Regional heterogeneity further defines Europe’s e-mobility trajectory. In Western Europe, where urban density and environmental regulation are high, BEVs are already taking the lead, particularly in zero-emission zones in cities like Paris and London. In contrast, Eastern European markets – characterized by lower purchasing power and limited charging infrastructure – continue to rely more heavily on ICE vehicles and mild hybrids, indicating a slower, more gradual transition.

Overall, Europe’s e-mobility shift is still moving forward but increasingly marked by flexibility, negotiation, and economic realism. While long-term decarbonization goals remain, the pace and shape of change will continue to be influenced by political will, regional conditions, and consumer readiness – making the road to 2035 more of a curve than a straight line.

How has China become a driver for E-Mobility – and where is it going now?

China has solidified its position as the global leader in electric vehicle adoption, accounting for over 60% of worldwide EV sales in 2024. Government policies have been instrumental in shaping this success, with a combination of stringent emissions regulations, subsidies, and the "Dual Credit" system, which penalizes automakers that fail to meet EV production targets while rewarding those who exceed them. Key initiatives, such as the extension of subsidies for new energy vehicles (NEVs) through 2027 and VAT exemptions for BEV purchases, have made EVs more accessible to a broader audience.

While government policies have laid the groundwork, consumer behavior has been pivotal in accelerating China's EV transition. Urban Chinese buyers are increasingly drawn to EVs for their low operating costs and exemption from driving restrictions. Domestic automakers are capitalizing on this – not just with affordable EVs like BYD’s $10.000 Seagull, but by also appealing to the tech-affinity of these often first-time buyers.

Consequently, BYD has emerged as the largest EV seller globally while tech-driven brands like NIO and XPeng focus on premium features such as advanced autonomous driving systems, battery-swapping technology, and connected ecosystems, catering to the demands of urban, tech-savvy buyers. Even lifestyle brands like Xiaomi have stepped into market with disruptive strategies, leveraging their established electronics expertise to offer highly affordable, feature-packed EVs

In 2025, EVs will represent around 36% of new cars made in China, a significant leap from just 5% in 2018. This growth is supported by an extensive charging infrastructure, with over 6 million public and private charging points now operational, concentrated in urban centers like Shanghai and Shenzhen. Furthermore, China dominates battery production, with companies like CATL and BYD leading global capacity, ensuring cost competitiveness and technological leadership.

China’s market dynamics reflect a shift towards innovation in battery technology, such as sodium-ion batteries and solid-state prototypes, which promise higher energy densities and reduced reliance on rare minerals. Looking ahead, the government’s 2060 carbon neutrality target underpins its strategy to decarbonize transport, setting ambitious goals for hydrogen fuel cells and electrified heavy-duty trucks.

However, the market is not without challenges. Charging infrastructure, though expanding, remains unevenly distributed, creating range anxiety in rural areas. Battery recycling is emerging as a critical issue, with government and private players ramping up efforts to establish sustainable disposal and reuse systems. As consumer expectations rise, innovation is essential. Emerging trends, such as customizable EVs and integration with smart home ecosystems, suggest that automakers must go beyond transportation solutions to win loyalty in this competitive landscape.

What is the Indian road towards electrification?

India's e-mobility landscape is rapidly evolving, driven by a complex interplay of policy, infrastructure development, and market dynamics. However, the transition is much more pronounced in two- and three-wheelers rather than in the traditional automotive segment.

The light electric mobility (LEM) segment is becoming a backbone of the EV-revolution in India and has shown remarkable growth: From roughly 400.000 units in 2018, approximately 2.5 million units this year, to a projected 6 million units in 2030. This rapid expansion is driven by the practical benefits of electric two-wheelers and e-rickshaws: Pairing a beneficial total cost of ownership with a lower dependency on charging infrastructure than electric cars, while providing a direct impact on reducing urban air pollution.

Looking specifically at cars and light commercial vehicles, the market data reveals a notable but only very gradual transformation. Electric vehicles (EVs), which were virtually non-existent in 2018, have started to emerge, capturing around 4% of the market in 2025. This is projected to grow to 25% by 2030, reflecting a slow but steady adoption of EVs.

ICE vehicles continue to dominate the car market, with 12V vehicles still achieving a 85% market share in 2025 and 51% in 2030. However, there is a positive shift towards greater efficiency within this segment. Start/stop systems are gaining traction, and a growing number of ICE powertrains are incorporating hybrid technologies.

The Indian government's policies are crucial in helping to shape and accelerate this transition. FAME II (Faster Adoption and Manufacturing of Electric Vehicles in India Phase II) plays a pivotal role in promoting EV adoption through subsidies and support for local production, though here as well the emphasis has been on electric two-wheelers and public transportation rather than passenger cars. Additionally, India is committed to increasing the share of renewable energy to reduce dependency on fossil fuels and the resulting indirect emissions from e-mobility. Currently they still account for 60% of the energy mix – primarily from coal – and only approximately 25% of coming from renewable energy sources. The government aims to double this by 2030. investments in cleaner technologies and renewable sources.

Where is the USA headed in terms of E-Mobility?

The United States remains a significant player in the global EV market, though it continues to trail behind China and Europe in terms of adoption. Efforts under the Biden administration, including landmark legislation like the Inflation Reduction Act (IRA), helped accelerate progress – but this momentum is now clouded by political uncertainty following Donald Trump’s reelection in 2024. His new administration has signaled a reversal of several climate-focused initiatives, including a possible rollback of federal emissions standards and a more lenient stance on fossil fuels. Legal challenges to state-level ICE bans are also emerging, creating additional friction.

While some federal programs like the IRA remain in place, their implementation is facing delays, and their long-term future is increasingly uncertain. In contrast, states such as California and New York are continuing to push ahead with aggressive clean energy and electrification goals. This patchwork of policies is keeping some momentum alive but highlights the growing divide between federal and state-level approaches.

In 2025, EVs will account for about 8% of new vehicles produced in the U.S., a notable increase from 2% in 2018, though recent data suggests a plateauing of demand, particularly outside coastal regions. California still accounts for over 40% of all EV registrations, underscoring the uneven geographic spread. Efforts to address range anxiety through public investment in charging infrastructure remain in motion under the Bipartisan Infrastructure Law, but progress is slow, with only a fraction of the 500,000 targeted public chargers installed so far. The U.S. also continues to attract significant investment in domestic battery production, but the lack of a cohesive national strategy risks compromising global competitiveness.

Consumer interest in EVs remains influenced by factors like fuel prices and climate awareness, but high vehicle costs and elevated interest rates are dampening mass-market uptake. Automakers are adjusting accordingly. General Motors and Ford, while publicly maintaining long-term electrification goals, have scaled back near-term EV investments and shifted focus to hybrids to meet consumer demand more flexibly. Tesla remains the market leader, supported by its proprietary Supercharger network and strong brand, but its U.S. market share is gradually declining as new entrants like Rivian and Hyundai-Kia expand their offerings. Legacy players such as Stellantis are also adopting cautious, diversified strategies to navigate the uncertain regulatory and market environment.

Despite clear technological advances, the U.S. EV market faces significant headwinds. Affordability remains a major barrier, and infrastructure development continues to lag behind consumer expectations, especially in rural and conservative regions. Without clear, consistent federal direction, there’s a growing risk that the U.S. could lose competitiveness in the global EV race – even as innovation persists in select states and among forward-looking manufacturers.

What makes Brazil’s automotive landscape unique?

Brazil’s automotive landscape is defined by its reliance on biofuels, particularly ethanol made from sugarcane, which dominates the energy mix and car fleet, positioning the country as a global leader in renewable fuel use. As a result, EV adoption remains modest, accounting for 6% of new car sales in 2024 – including plug-in hybrids. These vehicles are concentrated in urban centers like São Paulo, where infrastructure is more developed, but high costs and limited charging networks hinder broader adoption.

Government policies, like the Rota 2030 program, aim to bridge these gaps. Tax breaks and incentives for local EV assembly (e.g. BYD’s Brazil plant) promote efficiency improvements and emissions reductions across all vehicle types, including hybrids and flex-fuel models. Partnerships between automakers and energy providers are gradually expanding public charging networks, focusing on urban centers to lay the groundwork for broader electrification.

The pending EU-Mercosur trade agreement introduces new dynamics. The elimination of tariffs on over 90% of traded goods over 15 years would open up opportunities but also raises concerns about an influx of European EVs.

In response, the Brazilian government is negotiating safeguard measures to limit EV imports. This cautious approach underscores Brazil's need to balance the benefits of increased trade with the imperative to nurture its nascent EV sector.

Independent of how quickly the electrification market will grow – experts predict at most a 10% EV share (including plug-ins) by 2030 – biofuels are here to stay. As EV adoption grows, Ethanol will complement electrification, particularly for heavy-duty vehicles, flex-fuel hybrids like the Toyota Corolla, and rural areas where charging networks are limited – and Brazil will retain its distinct identity in the automotive world.

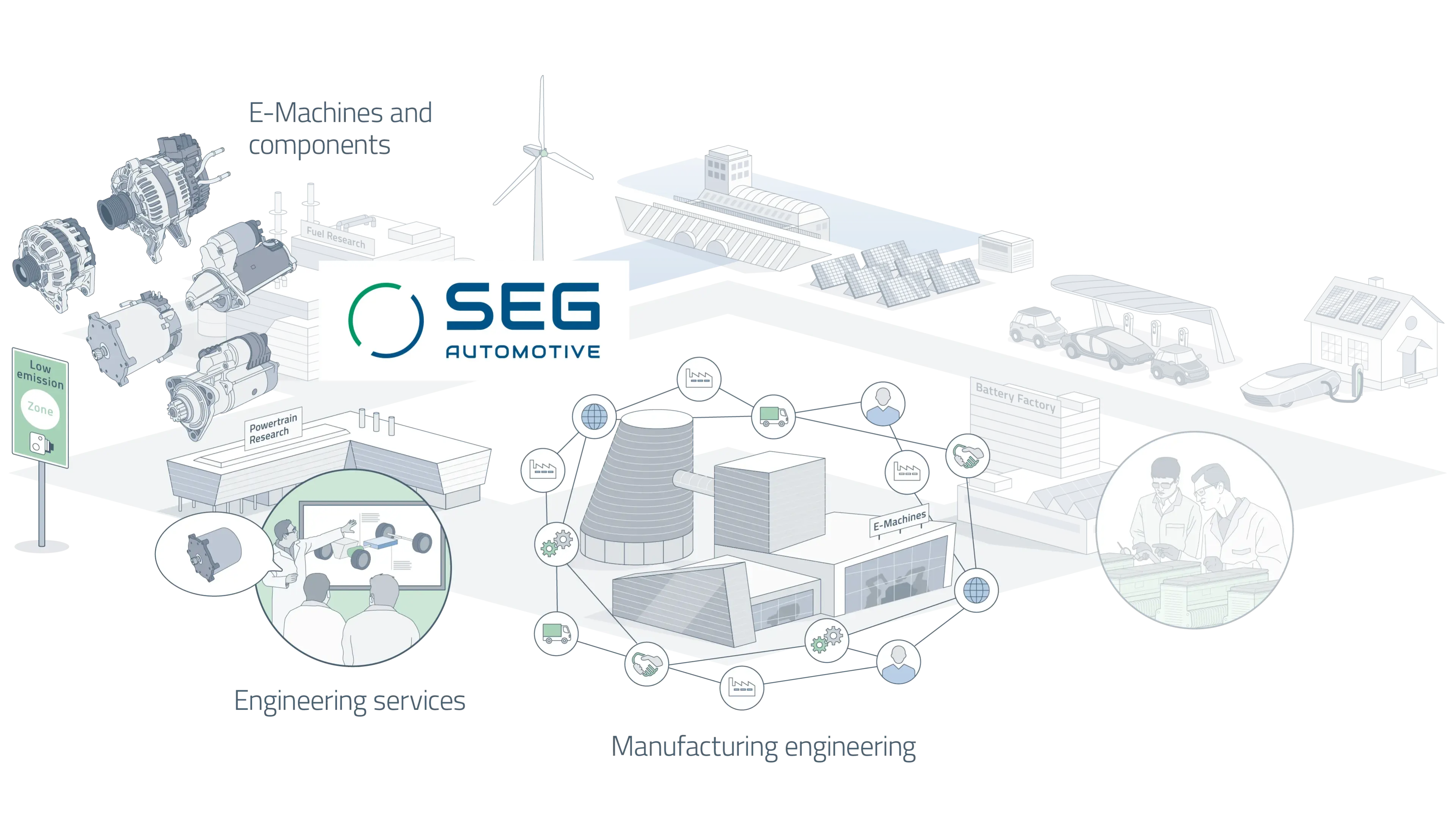

What is SEG Automotive's contribution to this transformation?

At SEG Automotive, we see ourselves as a reliable, global partner to the automotive industry on the path to electrification across all technologies. Our scalable system solutions and components provide support in virtually all steps of the value chain – from development services to manufacturing design.

Regardless of whether the energy for the vehicle comes from fuel, battery, or hydrogen, an electric motor will be found in virtually all powertrains of the future – and it must be as efficient, reliable, and cost-effective as possible to satisfy the world's thirst for energy and mobility in a climate-friendly way.

Help shape the future of mobility now!